From KYC to Cryptographic Trust: Identity Infrastructure for Institutional DeFi on Cardano

On-chain finance is entering a new phase. The question is no longer whether institutions are interested, but whether public blockchains are prepared to meet the operational, regulatory, and compliance requirements that institutional participation demands.

Recent regulatory developments — including U.S. legislative efforts such as the CLARITY Act and the GENIUS Act — signal a shift from uncertainty toward defined expectations around accountability, compliance, and consumer protection. At the same time, large-scale digital identity systems are maturing globally.

Europe is rolling out the European Digital Identity (EUDI) framework, MOSIP-based national ID programs are live across multiple regions, and U.S. policymakers are increasingly discussing digital identity as financial infrastructure.

Together, these trends point to a clear conclusion: identity is becoming foundational infrastructure for on-chain finance. The challenge is making that identity usable without sacrificing privacy, composability, or decentralization.

The regulatory and market shift: identity is no longer optional

Institutional finance operates under explicit constraints. KYC and AML obligations are continuous, not one-time events. Accountability, auditability, and risk management are embedded at every operational layer.

As regulatory clarity increases, institutions are no longer asking if they can engage with public blockchains, but under what conditions. These conditions increasingly resemble traditional finance:

- Verifiable counterparties

- Jurisdictional controls

- Clear responsibility boundaries

- The ability to demonstrate compliance without exposing unnecessary data

This convergence between regulation, national identity systems, and on-chain finance reflects a shared recognition that identity is the coordination layer of modern financial systems.

What institutions actually require to operate on-chain

Institutional participation involves far more than wallet-based access control. In practice, institutions require:

- Robust KYC and AML processes

- Whitelisting and permissioning of counterparties

- Role-based access for traders, operators, and administrators

- Multisignature custody and operational controls

- Infrastructure ownership and governance processes

Each of these requirements depends on identity management. Without a reliable way to define who is interacting with a system, under which role and policy constraints, none of these controls can be enforced.

This is why identity cannot be treated as an application feature — it is prerequisite infrastructure.

Why identity must be infrastructure — not embedded into every transaction

A common misconception is that compliance can be handled directly inside smart contracts. In reality, this approach does not scale.

Performing identity verification on every transaction is computationally expensive, operationally complex, harmful to user experience, and damaging to composability.

Institutions do not operate this way in traditional systems. Identity is established once, maintained over time, and referenced implicitly during execution. On-chain finance requires the same model.

This means identity must be:

- Reusable across transactions

- Pre-determined at execution time

- Externally managed, yet verifiable on-chain

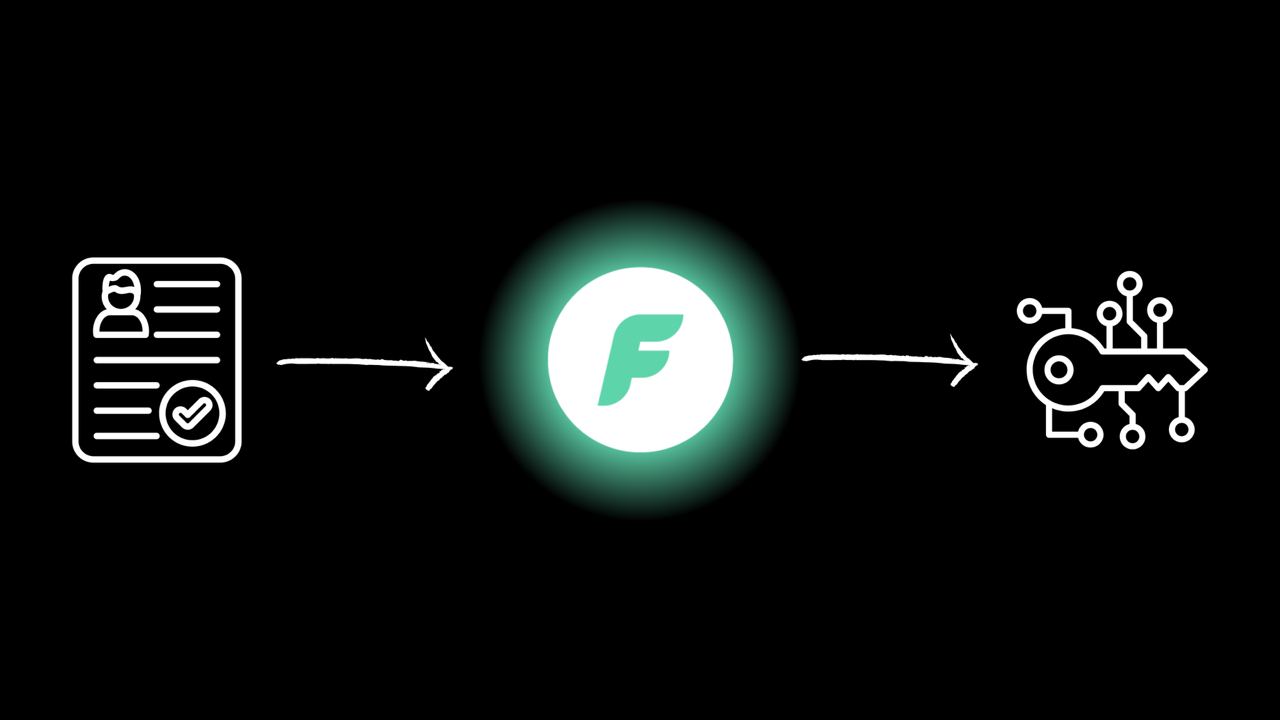

Achieving this requires a service layer — one that manages identity lifecycle, policy evaluation, and privacy-preserving verification without burdening smart contracts.

Midnight plays a critical role here, enabling confidential identity logic and compliance verification off the critical execution path, while producing deterministic signals that smart contracts can rely on.

Fairway operates at this intersection — orchestrating identity, compliance rules, and attestations so they are consumable by on-chain applications without embedding complexity into every transaction.

Privacy-preserving identity as the only viable path

Institutions require assurance — not exposure.

Publishing personal or organizational identity data on-chain is neither acceptable nor necessary. Privacy-preserving techniques allow participants to prove eligibility, authorization, or compliance without revealing underlying data.

This includes selective disclosure, jurisdiction-aware access control, and confidential policy enforcement. Privacy is not a contradiction to regulation — in many cases, it is a regulatory requirement.

Lessons from private chains and institutional L1s

Many institutions have responded by building private or permissioned systems. While operationally effective, these systems fragment liquidity, reduce composability, and create ecosystem silos.

The challenge is enabling institutional guarantees without abandoning public rails.

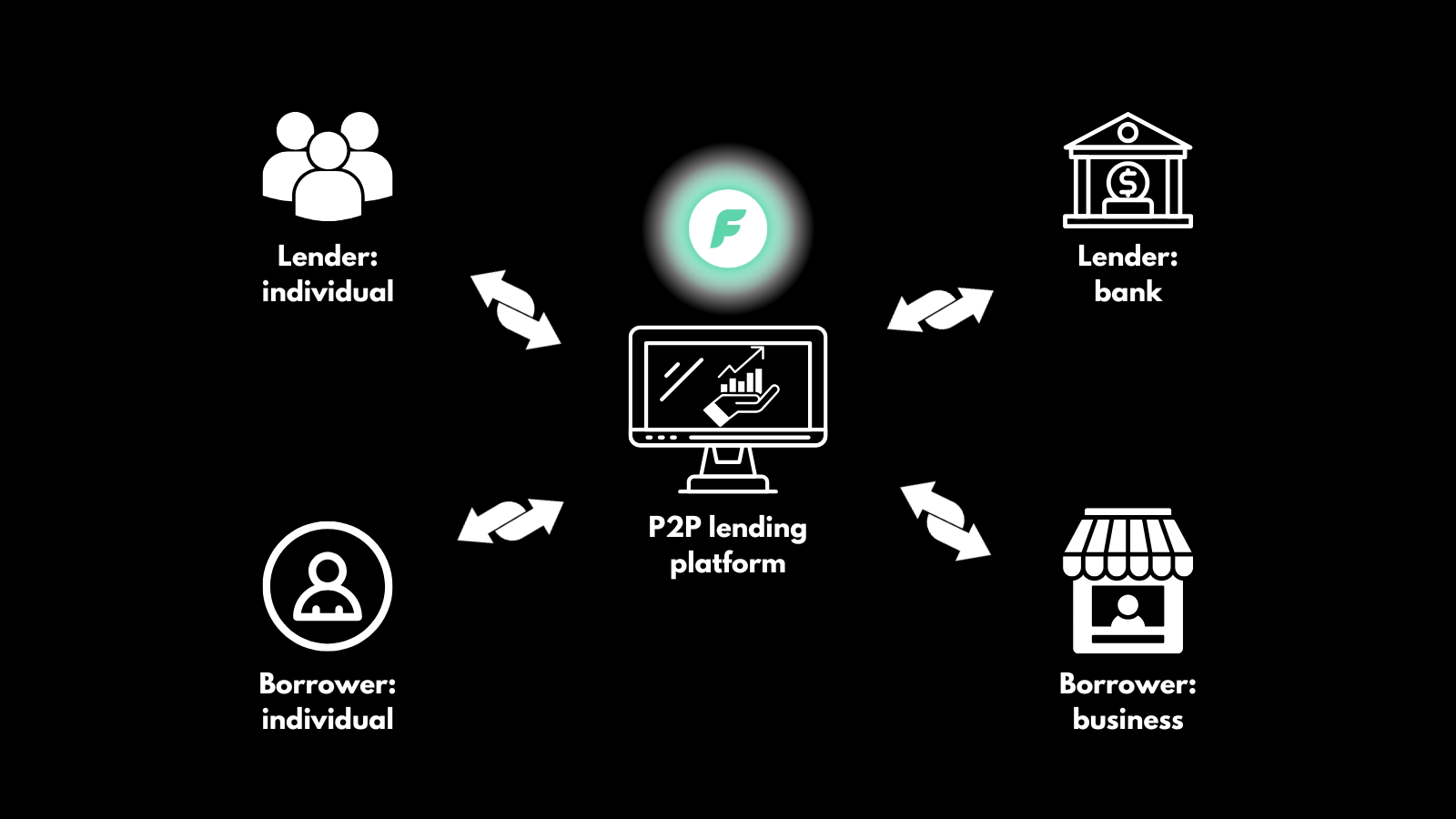

Fairway’s approach: making institutional identity usable on-chain

Fairway treats identity as shared infrastructure, not proprietary control.

By abstracting institutional requirements into reusable primitives, managing compliance logic off-chain or confidentially, and providing verifiable attestations, Fairway enables:

- Single-time identity establishment

- Continuous compliance enforcement

- Simple, composable smart contracts

Building a sustainable future for Cardano DeFi

Without reusable identity infrastructure, institutional activity will continue migrating toward private systems. With the right identity layer, public networks can remain open while supporting real-world financial constraints.

Cardano’s architecture makes it particularly well-suited for this evolution — but only if identity is treated as infrastructure, not an afterthought.

Solving identity at the service layer is how decentralization, compliance, and usability coexist — and how public blockchains mature without losing what makes them public.

Heikki Ruhanen

Co-Founder and COO of Fairway, working at the intersection of technology and business. He focuses on product execution, system architecture, and operational strategy, translating Web3 and cryptography concepts into scalable, compliant infrastructure, with a strong emphasis on decentralized identity, privacy-preserving systems, and sustainable tokenomics.